How To Check Your Capital One Application Status Online: A Simple Guide

Updated: 30 Aug 2024

135

Waiting is always hard. This is the case with users after applying for a Capital One credit card.

If you feel it takes an eternity to find out the status of your application, fear not. Capital One answers “How To Check Capital One Application Status” to ease your pain of waiting after applying.

In this guide, I will explain how to check your application status and put your nerves at ease by outlining two simple methods: online and by phone.

So, let’s make things easy together!

How To Check Capital One Application Status

When you apply for a pre-approved offer at Getmyoffer.Capitalone.com, you may need to wait from seconds to days. This could make users fret because waiting always seems nerve-wracking due to the doubtfulness of what will happen next. But there’s no need to worry!

Monitoring your Capital One application status is straightforward and ensures you stay informed about its progress at every stage. Capital One provides various tools to easily track the progress of your application, whether you applied today or plan to apply soon.

Capital One Credit Card Application Status: Two Best Methods

There are two primary ways to check your Capital One application status:

- Online via the Capital One Official Website

- Via Phone by Calling Capital One Customer Support

Both methods are simple and effective, so you can choose the one that best suits your needs.

1. Online Via Capital One Official Website

Checking your application status online is quick and easy. Here’s how to do it:

1. Visit the Application Center:

- You can access the Capital One login page using your web browser on any device (mobile, tablet, or laptop).

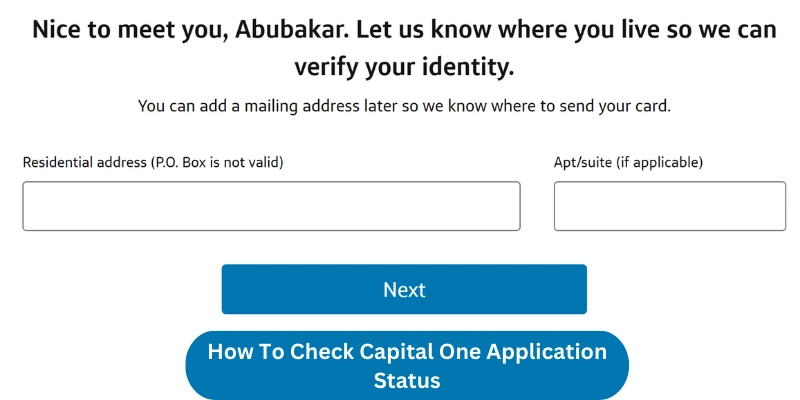

2. Enter Your Details:

- Provide the last four digits of your Social Security Number (SSN).

- Enter your Date of Birth.

- Input your Zip code.

- Click the “Sign In” button.

2. View Your Application Status:

- Once signed in, you can immediately see whether your application has been approved, rejected, or is still pending.

3. Review and Update:

- If your application is pending, review it for any further requirements. You can update your information or provide additional documents to strengthen your application.

4. Via Phone

If you prefer or need to check your application status over the phone, follow these steps:

5. Dial the Number:

- Call Capital One’s official customer support number at 800-903-9177.

6. Follow the Prompts:

- Listen to the automated prompts and press the number that connects you to a Capital One representative.

7. Request Your Application Status:

- Once connected, request that the representative check your application status. You may need to mention some personal information along with your SSN, and your physical address may be used to verify your identity.

8. Get Your Status:

- The representative will then inform you of your application’s status, whether approved, pending, or rejected.

Regardless of your chosen method, providing accurate information to verify your identity is essential. This will ensure a smooth process in tracking your application status.

Understanding Pending Status: Reasons & Next Steps

If your Capital One application status is pending, it might be due to one or more of the following reasons:

1. Further Verification Needed:

- Sometimes, the Capital One team may need additional documents to verify your identity. If so, promptly update your application and provide the required information.

2. Credit History Review:

- Capital One might be reviewing your credit history to assess your eligibility. Ensuring your financial credit history is in good standing can improve your chances of approval.

3. Existing Accounts:

- If you already have an existing account with Capital One, avoid applying for a credit card through a new account. Instead, log in to your current account and apply for your preferred credit card.

4. High Volume of Applications:

- Capital One may receive many applications during promotional periods or pre-approved offers, which can delay the review process. In such cases, patience is vital.

Note: If you are waiting for an extended time for application approval or disapproval, it is better to ask support for clarification so you can move ahead with your needs without being in a constant state of waiting.

Also check the below video for more details:

Capital One Credit Card Application Decision Time

So, if you are concerned about which factors could affect the decision time for your credit card application, here is the answer: the decision is based on how you choose to apply for a Capital One credit card.

- You may get your response in 60 seconds for Online or Phone Applications.

- On the other hand, if you choose to submit a paper application, it could take you 7 to 10 working days to know the status of your application (in this case, usually a mail is being sent with an approval or rejection, so choose wisely your method of application; considering the time it takes to proceed). When submitting your information, you must enter your reservation and access codes during application submission to display your eligibility for the exclusive rewards.

Instant Credit Application Rejection: Common Reasons Explained

If your credit card application is rejected or delayed, here are some common reasons:

1. Missing Information:

You may have forgotten to include the required information, and incomplete application information about your full name, SSN, Date of Birth, physical address, or annual income could cause an immediate rejection. That is why experts typically recommend double-checking personal information to ensure the application can be completed accurately.

2. Mistakes in the Application:

Even minor errors, like spelling mistakes, can lead to issues. Ensure all information, including your name, address, and bank details, is correct before applying.

3. Frozen Credit Card:

A frozen credit card account could cause delays or rejection. Make sure your account is active before applying.

Importance of Tracking Your Capital One Application Status

Keeping a constant update on the application status for your next Capital One credit card could be crucial for the following:

- It keeps you alert to where your application stands, whether approved, pending, or rejected.

- You won’t feel a fear of unknown consequences.

- Staying informed will prepare you for the next steps, whether that involves submitting additional information, correcting any errors, or simply waiting patiently.

Final Thoughts

I trust that you understand how to check your Capital One application status. This information will update you on your application’s progress, whether it has been approved, pending, or rejected.

I recommend following the steps outlined above so you can easily track your application status online or by calling Capital One customer support.

If your application is pending, try to contact every possible inconvenience by providing updated information.

Have you checked your Capital One application status? If it’s pending, feel free to ask for help in the comments section—we’re here to assist you!